Insurance policies and the coverage provided for mold remediation vary. Standard homeowner's insurance policies might offer limited or no coverage for mold damage, often treating it as a maintenance issue that falls under the homeowner’s responsibilities.

Guide

Mold can concern any homeowner because of its potential property damage and health risks. It’s commonly found in damp and humid conditions within homes and can cause respiratory problems. It can also decrease the value of your property, posing a significant issue to not only your health but also to potential buyers. Addressing mold promptly is crucial to lessen these risks. One pressing question always comes up: Who is financially responsible for mold remediation?

Understanding Mold Remediation

Mold remediation is the process of removing and cleaning up mold from an indoor environment, aiming to bring mold levels back to normal, natural levels. The importance of professional mold remediation services cannot be overstated, especially when dealing with extensive mold growth or dangerous types like black mold. The remediation process is influenced by factors including the extent of mold damage and the area affected. The process often involves mold assessment, testing, and using specialized equipment to get rid of mold spores.

Homeowners and Mold Remediation

Homeowners’ insurance policies occasionally cover mold remediation, particularly if the mold results from a “covered peril” like a burst pipe or roof leak. Coverage can vary, with many policies setting specific limits or conditions on mold remediation costs. It’s crucial to review your insurance coverage details to understand the specifics and know how to file a homeowners’ insurance claim in case the situation arises. Unfortunately, in instances of neglect or unaddressed moisture problems, homeowners will likely find themselves bearing the full cost of mold remediation.

Landlords and Renters

Landlords are generally responsible for maintaining habitable living conditions, which include addressing mold issues. However, tenants might be liable for remediation costs if their actions or inactions, like not using a dehumidifier in humid conditions, lead to mold growth. In cases like this, communication is key; tenants should report mold immediately to stop the problem from worsening.

Condominiums and Shared Properties

In condominiums, the responsibility for mold remediation can get complicated. The documents and association policies that govern the complex play the biggest role in determining who pays for what. It’s highly recommended to review these policies before an issue arises so that you can be prepared in case it’s ever needed.

Insurance Policies and Additional Coverage

Insurance policies and the coverage provided for mold remediation vary. Standard homeowner’s insurance policies might offer limited or no coverage for mold damage, often treating it as a maintenance issue that falls under the homeowner’s responsibilities. This is particularly true for mold problems that arise over time due to persistent moisture, leaks, or humidity. However, when mold results from a covered peril—such as water damage from a burst pipe or a roof leak that is promptly reported—homeowner’s insurance may cover the mold remediation cost.

Flood Insurance and Mold

Flood insurance is a unique case. Standard homeowner’s policies typically do not cover flood damage, including related mold issues. Homeowners should purchase separate flood insurance policies, which are available through the National Flood Insurance Program (NFIP) or private insurers, for protection against floods.

If mold growth results from a flood covered by such a policy, mold remediation may also be covered. However, the coverage may depend on the timely reporting and remediation of flood damage to prevent mold growth.

Riders and Add-ons for Mold Coverage

Homeowners concerned about mold remediation costs should consider additional coverage options, given the limitations of standard policies regarding mold. Insurance companies offer riders or add-ons for mold damage, which can expand coverage beyond the constraints of a standard policy. These add-ons can cover the costs of mold remediation up to a certain limit, which can be a valuable investment for properties with areas prone to mold problems, like crawlspaces and basements.

Navigating Mold Remediation Claims

Documentation is essential if you need to file a claim for mold removal and remediation. Photographs, detailed notes, and clear communication with your insurance company can aid in the claims process. Should your claim be denied or only partially covered, understanding the reason and knowing your options is vital and comes with thorough research.

Other Relevant Insurance Considerations

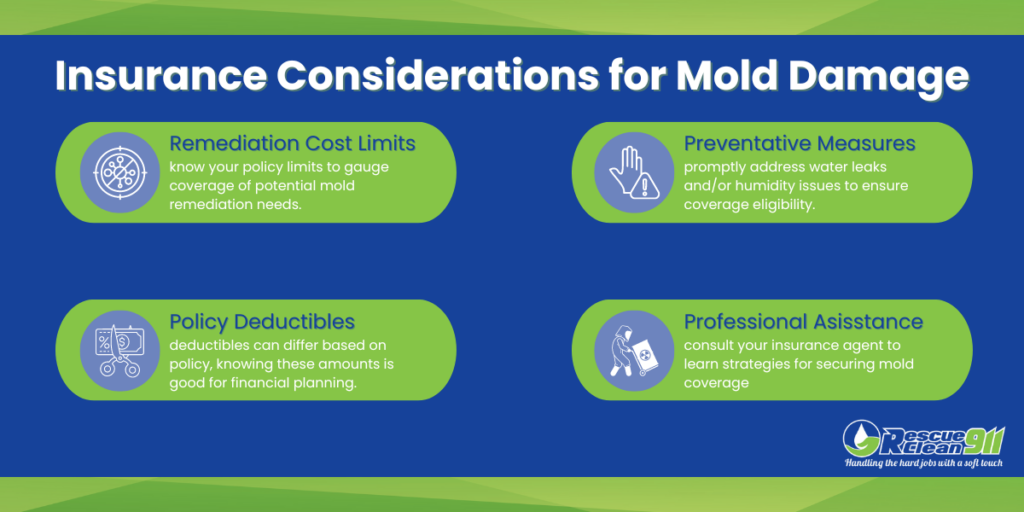

- Mold Remediation Cost Limits: Some policies or riders that cover mold remediation set specific cost limits– understand these limits to gauge whether they fully cover potential mold remediation needs.

- Deductibles: Policies covering mold might have a separate deductible for mold claims, which can be higher than the standard deductible – know the deductible amounts for financial planning reasons.

- Preventive Measures and Maintenance: Insurance might not cover mold damage resulting from neglect or failure to maintain the property. Homeowners should keep their homes well-maintained and promptly address water leaks or humidity issues to ensure coverage eligibility.

- Professional Assistance: Consulting with an insurance agent or a property insurance specialist can clarify the best strategies for securing mold coverage. They can offer insights into the policies, riders, or add-ons that best fit your needs and property risks.

Preventing Mold Growth

Prevention is the best strategy against mold. Ensuring good ventilation, controlling humidity levels, and promptly addressing water damage can significantly reduce the risk of mold growth. Reducing indoor humidity by venting bathrooms, dryers, and other moisture-generating sources is good practice, along with preventing condensation on cold surfaces (piping, windows, walls, etc). Regular mold inspections can also help catch and address moisture problems early.

Let Rescue Clean 911 Be Your Go-To for Resources and Remediation!

Navigating the complexities of a mold infestation in your home can be daunting. Understanding your insurance policy and recognizing the importance of regular maintenance are critical steps in mold prevention. When mold makes an unwelcome appearance, time is of the essence. Quick action helps mitigate health risks associated with mold exposure and helps limit the extent of the damage and, potentially, the costs of remediation.

Let Rescue Clean 911 be your ally. Our expertise in mold remediation comes with a deep understanding of various types of mold and the most effective strategies for removal and prevention. We offer resources that can help you identify potential mold problems, understand the risks, and take preliminary steps toward mitigation.